Tickmill is a globally recognized ECN broker that delivers fast execution, low-cost trading, and institutional-grade transparency. With its MT5 WebTrader platform, the broker enables clients to trade directly from any browser without software installation, providing instant market access and an intuitive interface.

Tickmill is particularly popular among professional traders, scalpers, and algorithmic system users due to its tight spreads, reliable execution, and commitment to fair trading conditions. Founded on principles of transparency and technology, Tickmill combines efficiency with trust — a hallmark of its international reputation.

Trading Environment and Technology

Tickmill’s trading environment is designed for speed, precision, and simplicity. The MT5 WebTrader allows traders to execute orders instantly from any device, eliminating the need for downloads or complex setups.

The platform offers one-click trading, real-time market data, and detailed charting tools, ensuring efficient trade management. Execution is powered by high-speed servers connected to major liquidity providers, minimizing latency and slippage — essential features for traders who rely on precision and fast reaction times.

Regulation and Security

Tickmill operates under multiple respected financial regulators, ensuring full compliance and safety for its global client base.

These licenses guarantee transparency, secure fund management, and adherence to international standards.

Tickmill is regulated by:

- FCA — Financial Conduct Authority (United Kingdom)

- CySEC — Cyprus Securities and Exchange Commission

- FSA — Financial Services Authority (Seychelles)

All client funds are stored in segregated accounts with top-tier banks. The broker also enforces negative balance protection and uses advanced SSL encryption to ensure full data security across all transactions.

Account Types and Trading Conditions

Tickmill offers several account types to suit different trader profiles and strategies.

Each account provides ECN-style execution, tight spreads, and low commission structures.

| Account Type | Minimum Deposit | Spread (EUR/USD) | Commission | Execution Model | Suitable For |

|---|---|---|---|---|---|

| Classic Account | $100 | From 1.6 pips | None | STP | Beginners, casual traders |

| Pro Account | $100 | From 0.0 pips | $2 per side per lot | ECN | Scalpers, professionals |

| VIP Account | $50,000 | From 0.0 pips | $1 per side per lot | ECN | High-volume and institutional traders |

All accounts support hedging, Expert Advisors (EAs), and scalping strategies. The ECN model ensures direct access to liquidity providers, meaning orders are filled quickly and at the best available prices.

Trading Instruments

Tickmill gives traders access to a wide range of global financial instruments, allowing diversification and exposure to multiple asset classes.

The broker’s infrastructure supports trading across major markets with consistent execution quality.

The instruments available include:

- Forex — 60+ currency pairs with spreads starting from 0.0 pips.

- Indices — Major global stock indices such as NASDAQ, S&P 500, and DAX.

- Commodities — Gold, silver, oil, and agricultural assets.

- Bonds — Trade German government bonds with real-time pricing.

- Cryptocurrencies — Bitcoin, Ethereum, and other major coins (region dependent).

Each market benefits from deep liquidity and real-time price feeds, ensuring accurate and fast order execution for all trading styles.

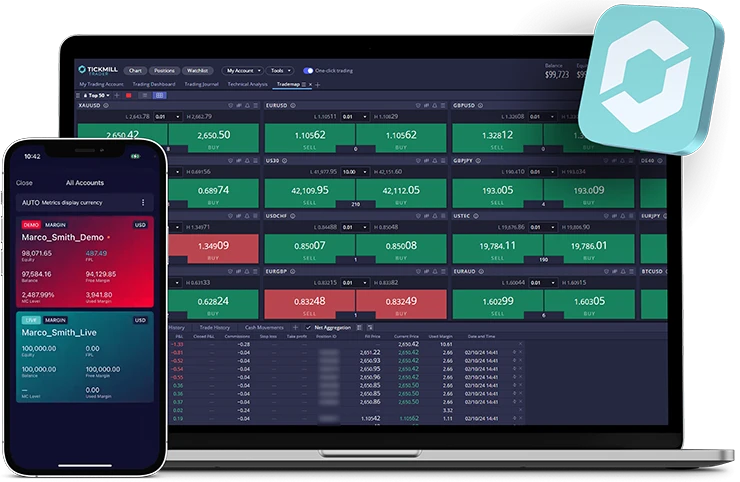

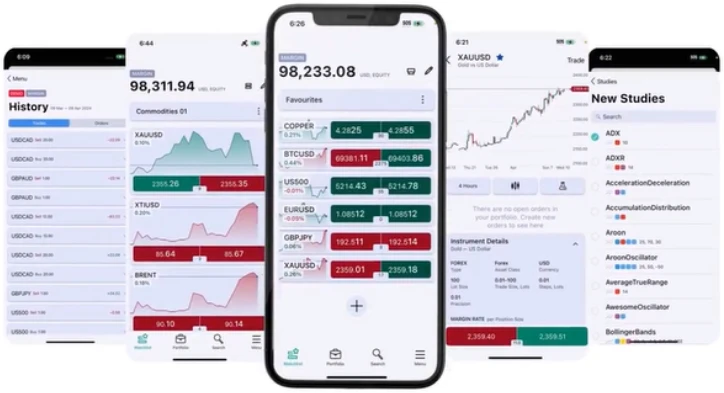

MT5 WebTrader Platform

The MT5 WebTrader platform from Tickmill is a browser-based trading solution offering the same power and functionality as the desktop version.

It’s ideal for traders who prefer flexibility and mobility without compromising analytical capabilities.

Key features include:

- Instant market access with no software installation required.

- One-click trading for fast execution.

- Detailed and customizable charts with multiple timeframes.

- Full market depth for price transparency.

- Support for all order types (market, pending, stop, and trailing).

- Advanced analytical tools including 80+ built-in indicators.

The platform’s lightweight design ensures smooth operation even under low-latency conditions, making it suitable for high-speed trading environments.

Leverage, Spreads, and Execution

Tickmill is known for its ultra-low spreads and fast execution speeds, made possible through its ECN infrastructure.

Spreads on major pairs like EUR/USD start from 0.0 pips, while commissions remain among the lowest in the industry.

The broker offers leverage up to 1:500, depending on jurisdiction and account type, giving traders the flexibility to adjust position sizes based on risk tolerance.

All orders are executed using a no dealing desk (NDD) model, ensuring transparency, fairness, and minimal slippage.

Education and Analytical Resources

Tickmill places strong emphasis on trader education and market research, offering comprehensive learning materials for both new and experienced traders.

These resources are designed to help clients improve their trading knowledge and analytical skills.

Available resources include:

- Webinars and video tutorials led by professional analysts.

- Market analysis and outlook reports updated daily.

- Trading guides and eBooks explaining strategies and risk management.

- Economic calendar and forex calculators for planning trades.

By combining education with transparent execution, Tickmill ensures traders have the tools needed to make informed decisions.

Why Traders Choose Tickmill

Tickmill stands out for its commitment to low-cost trading, transparency, and high-speed performance.

Below are the key reasons why traders choose this broker:

- Regulated by FCA, CySEC, and FSA for strong financial oversight.

- Minimum deposit of $100, accessible for most traders.

- Spreads from 0.0 pips with ECN execution.

- MT5 WebTrader with real-time charts and one-click trading.

- Supports hedging, scalping, and EAs.

- Fast execution speeds and deep liquidity from top-tier providers.

These strengths make Tickmill one of the most trusted and cost-efficient brokers in the global trading industry.