IC Markets is one of the leading global brokers, known for its tight spreads, high-speed execution, and institutional-grade liquidity. The platform is designed to meet the expectations of professional traders, scalpers, and algorithmic system users who demand precision and transparency in every trade. With a strong regulatory framework and access to advanced trading technologies, IC Markets has become a trusted choice for serious market participants.

Trading Environment and Technology

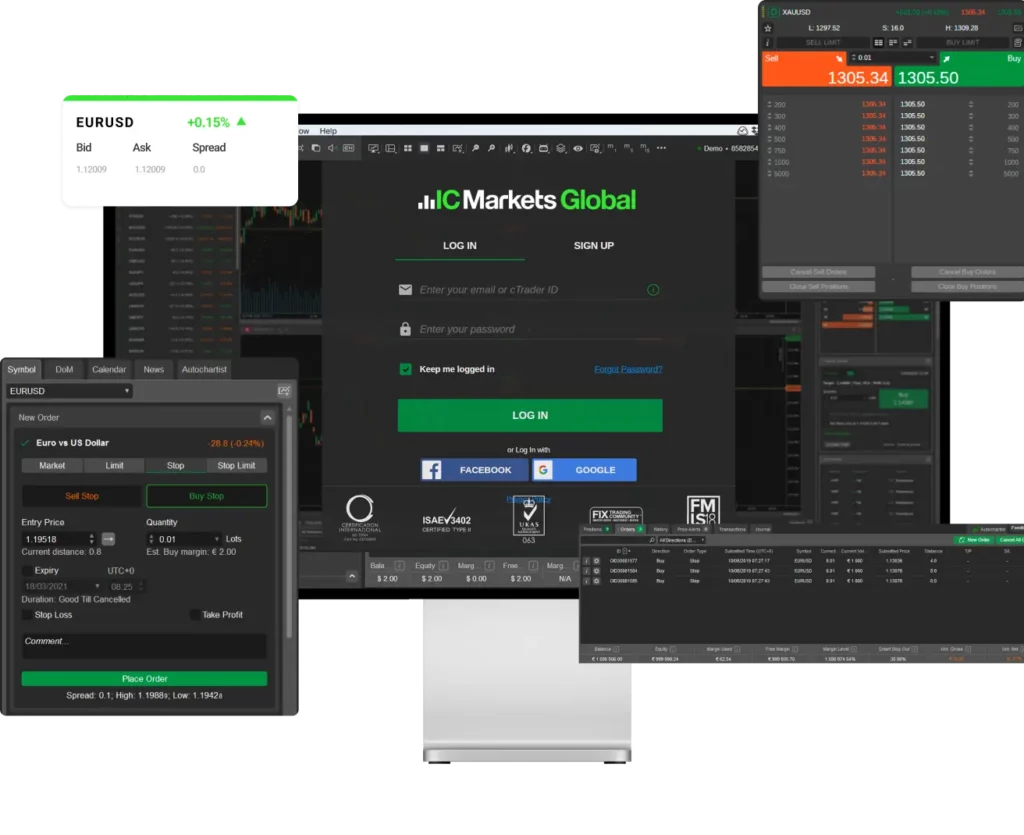

The broker’s MT5 WebTrader platform delivers a seamless experience, giving traders access to the markets without the need to install additional software. It supports all major browsers, allowing users to open, modify, and close positions from any device connected to the internet.

Thanks to servers strategically located in premium data centers, IC Markets ensures ultra-fast trade execution with average speeds below 40 milliseconds. This minimizes slippage and enhances order precision — a crucial advantage for traders using automated systems and high-frequency strategies.

Account Types and Conditions

IC Markets offers several account types to meet different trading goals and styles. Each account provides direct market access and institutional-grade pricing.

Before choosing an account, it’s important to consider spreads, commissions, and trading style preferences.

| Account Type | Spreads | Commission | Suitable For |

|---|---|---|---|

| Raw Spread Account | From 0.0 pips | $3.50 per side per lot | Scalpers, algorithmic traders |

| Standard Account | From 1.0 pips | No commission | Manual traders, beginners |

Both accounts come with flexible leverage options and a minimum deposit of $200, making them accessible to a wide range of traders. Instant execution and low latency are available across all account types.

Available Instruments

IC Markets provides access to a wide range of financial markets, allowing traders to diversify their portfolios and strategies.

Below is a list of key trading instruments offered by the broker:

- Forex — Over 60 currency pairs, including major, minor, and exotic pairs.

- Indices — Trade global indices such as NASDAQ, DAX, S&P 500, and FTSE.

- Metals — Gold, silver, and other precious commodities with competitive spreads.

- Cryptocurrencies — Trade Bitcoin, Ethereum, and other digital assets 24/7.

Each category comes with raw pricing, deep liquidity, and reliable execution speed — ensuring consistent performance across all markets.

Regulation and Security

Before choosing a broker, traders should always verify its regulatory background and client protection measures.

IC Markets operates under multiple internationally recognized regulators, ensuring transparency and compliance with global financial standards.

The broker holds licenses from:

- ASIC — Australian Securities and Investments Commission

- CySEC — Cyprus Securities and Exchange Commission

- FSA — Financial Services Authority, Seychelles

All client funds are held in segregated accounts with top-tier banks, providing maximum security and peace of mind.

Trading Platforms and Tools

IC Markets supports a full suite of professional-grade trading platforms designed for flexibility and performance.

The MT5 WebTrader version is particularly valuable for traders who prefer browser-based trading without installations.

In addition to MT5, IC Markets also offers:

- MetaTrader 4 (MT4) — The industry standard for Forex trading.

- cTrader — A platform for advanced charting, order management, and algorithmic trading.

- Mobile Apps — iOS and Android applications for traders on the go.

These platforms come with advanced features such as customizable charts, technical indicators, and built-in trading signals.

Deposit and Withdrawal Options

IC Markets provides multiple funding methods to ensure fast and convenient transactions.

Before choosing a method, traders should consider processing times and possible currency conversion fees.

Available options include:

- Bank Transfers — Suitable for large deposits.

- Credit/Debit Cards — Fast processing with secure payment gateways.

- E-Wallets — Skrill, Neteller, PayPal, and others for instant funding.

- Cryptocurrency Payments — Bitcoin and other supported digital assets.

Most deposits are processed instantly, while withdrawals are typically completed within one business day.

Education and Research Resources

IC Markets understands that knowledge and continuous learning are essential for success in trading.

To support its clients, the broker provides educational and analytical materials that help traders at all levels improve their decision-making.

Resources include:

- Webinars and video tutorials explaining technical and fundamental strategies.

- Market analysis reports updated daily by in-house experts.

- Economic calendars and trading calculators to plan trades effectively.

- Guides for beginners, covering platform setup and basic trading concepts.

These tools empower traders to build confidence and develop their own consistent trading systems.

Why Traders Choose IC Markets

Many traders select IC Markets for its combination of low trading costs, fast execution, and professional infrastructure.

Here are the main reasons why this broker stands out in the industry:

- Raw spreads starting from 0.0 pips

- Execution speed under 40ms for precision trading

- Advanced MT5 WebTrader and multi-platform access

- Over 200+ trading instruments across global markets

- Strong regulation and fund protection mechanisms