Exness Islamic Account

Exness Islamic accounts, tailored for adherence to Islamic finance principles, enable traders to participate in financial markets in line with Sharia law. These swap-free accounts, popular among Muslim investors, offer a faith-consistent trading platform without compromising religious beliefs.

Islamic Account Principles in Trading

Islamic finance operates under a unique set of principles that distinguish it from conventional financial systems. These principles ensure that all transactions are conducted in a manner that is not only ethical but also in compliance with Islamic law. The Exness Islamic Account adheres to these principles, providing a trading environment that is both productive and religiously acceptable.

Prohibition of Riba (Interest)

One of the foundational principles of Islamic finance is the prohibition of riba, or interest. This rule stems from the belief that money should not be treated as a commodity that can generate profit through interest payments. In the context of trading, this means that the Exness Islamic Account does not involve any interest charges or gains, such as those typically found in swap fees for holding positions overnight.

Prohibition of Gharar (Uncertainty)

Gharar refers to uncertainty or ambiguity in financial transactions, which is considered haram (forbidden) in Islamic finance. This principle ensures that all parties in a transaction have clear, accurate information, thereby avoiding any form of deceit or misinformation. The Exness Islamic Account is designed to eliminate gharar by providing transparent trading conditions and ensuring that all contract terms are clear and straightforward.

Prohibition of Haram (Forbidden) Industries

Islamic finance also prohibits investment in industries that are considered haram, such as alcohol, gambling, and pork production. The Exness Islamic Account respects this principle by offering access to a wide range of markets that exclude any industries not in compliance with Islamic law.

What is Swap-Free for Islamic Countries?

Exness offers swap-free accounts automatically for users from specific Islamic countries, aligning with Islamic law by eliminating swap fees on overnight orders. This ensures that Muslim traders can engage in financial markets without compromising their religious principles. These accounts, applicable across all trading instruments, maintain a zero-swap policy. However, Exness reserves the right to revoke swap-free status in cases of abuse, which would result in the application of administration fees for future orders.

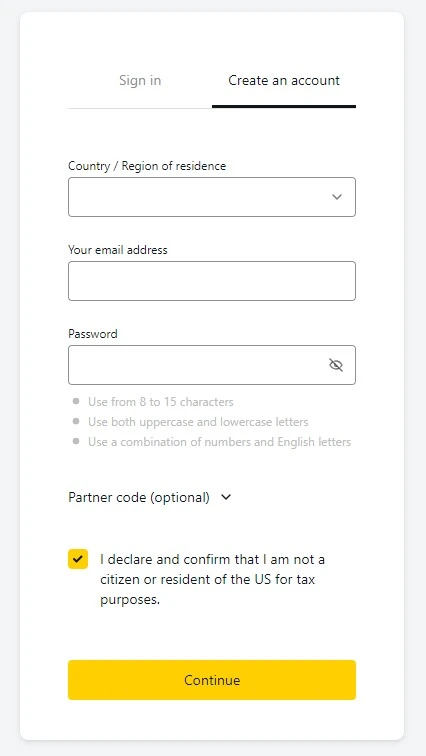

How to Open an Islamic Account with Exness

Opening an Islamic Account with Exness is a straightforward process, designed to be accessible while ensuring compliance with Islamic finance principles.

Step-by-Step Guide to Opening Exness Islamic Account

To open an Islamic Account with Exness, follow these steps:

- Visit the Exness website and select the option to open a new account.

- Choose the Islamic Account option during the registration process.

- Complete the registration form with your personal and contact details.

- Agree to the terms and conditions, which include compliance with Islamic finance principles.

- Submit the required documents for identity and address verification.

- Wait for confirmation of account verification, which typically takes a few business days.

- Once verified, deposit funds into your account using one of the provided payment methods.

- Begin trading on the platform, with access to swap-free trading conditions.

Document Requirements

To open an Islamic Account with Exness, you will need to provide:

- A valid government-issued ID (passport, national ID card).

- Proof of address (utility bill, bank statement).

These documents are necessary for the verification of your identity and residence, in line with regulatory requirements and to ensure the integrity of the trading environment.

Account Verification Process

After submitting your application and required documents, the verification process includes:

- Initial review of submitted documents for authenticity and completeness.

- Detailed verification of the information provided against global compliance databases.

- Assessment of financial knowledge and trading experience, if applicable.

- Confirmation of your eligibility for an Islamic Account based on the provided information and compliance checks.

- Notification of account verification status via email, including any further steps if necessary.

- Activation of your Islamic Account upon successful verification, allowing you to start trading under swap-free conditions.

Available Exness Platforms for Islamic Account

Exness provides Islamic Account holders with a selection of trading platforms that ensure compliance with Islamic finance principles, including:

- MetaTrader 4 (MT4): A popular platform known for its analytical capabilities, trading flexibility, and customizability. Exness MT5 offers advanced charting tools, technical indicators, and Expert Advisor functionality for automated trading.

- MetaTrader 5 (MT5): An advanced multi-asset platform that builds upon the features of Exness MT4, offering enhanced trading functionalities, more technical indicators, and the ability to trade stocks and futures.

- Web Terminal: A convenient browser-based platform that requires no downloads or installations, allowing traders to access their accounts and the markets directly from the web. Exness Web Terminal provides full trading capabilities, robust security, and flexibility.

- Mobile Application: Available for Android and iOS, the Exness mobile app offers comprehensive trading and account management features. Traders can execute trades, analyze markets, and manage their accounts from anywhere, at any time.

Benefits of Exness Islamic Account

The Exness Islamic Account is structured to cater to the unique needs of Muslim traders, aligning with the principles of Islamic finance while offering an extensive range of trading benefits. These include:

- Interest-free Trading: Compliant with Shariah law, the account eliminates swap or rollover fees on overnight positions, ensuring that trading practices do not involve interest.

- No Rollover Fees: Traders can maintain their positions for an extended period without the worry of incurring extra charges, facilitating long-term trading strategies.

- Transparent and Fair Trading Conditions: Exness is committed to providing a clear and straightforward trading environment. This means no hidden fees or unexpected charges, ensuring fairness and transparency in every transaction.

- Access to a Wide Range of Markets: The Islamic Account offers trading opportunities in forex, commodities, indices, and more, allowing traders to diversify their portfolios while adhering to Islamic finance principles.

- Dedicated Islamic Account Support: Exness provides specialized customer support for Islamic Account holders, ensuring that they receive timely assistance and guidance tailored to their needs.

- Exness Legal Assurance: Trading with an Exness Islamic Account comes with the peace of mind of knowing you’re dealing with a legally compliant broker. Exness adheres to international legal standards and regulations, ensuring the security and integrity of your trading activities.

Summary

The Exness Islamic Account bridges the gap between modern financial trading and Islamic finance principles, ensuring a compatible and respectful environment for Muslim traders. By removing riba and gharar, and excluding haram industries from its trading instruments, it sets a standard for ethical and compliant trading practices. The account’s design around transparency, equity, and dedicated support further elevates its appeal, providing a reliable and comprehensive trading solution for those seeking to navigate the financial markets within the guidelines of their faith.

FAQs about Islamic Account

What defines an Exness Islamic Account?

An Exness Islamic Account is designed to conform to Islamic finance regulations, prohibiting riba (interest), eliminating gharar (uncertainty), and avoiding investments in haram (forbidden) sectors. This account allows traders to participate in financial markets while strictly adhering to Sharia law.

Who can open an Exness Islamic Account?

Anyone looking to trade in accordance with Islamic finance principles is eligible to open an Exness Islamic Account. Though primarily aimed at Muslim traders, it also attracts individuals interested in ethical trading practices, regardless of their faith.

How does Exness ensure the Islamic Account is Sharia-compliant?

Exness guarantees Sharia compliance for its Islamic Accounts by offering them as swap-free, ensuring all transactions are transparent to prevent gharar, and carefully selecting tradable assets to exclude those from haram industries, thus maintaining ethical trading standards.

Are there extra charges associated with the Exness Islamic Account?

There are no extra charges for the Exness Islamic Account. It is designed to exclude interest and rollover fees, embodying the principles of Islamic finance by providing a transparent and equitable trading environment without hidden costs.

Is it possible to convert a regular account to an Exness Islamic Account?

Yes, converting a regular account to an Exness Islamic Account is facilitated by Exness. Traders need to request this change through customer support, and the conversion is subject to a verification process and approval, ensuring compliance with Exness’s guidelines and the trader’s eligibility for an Islamic Account.