Exness Trading Calculator

The Exness Calculator is crucial for traders, offering functionalities for informed decision-making. It helps estimate profits, assess risks, and set investment goals, seamlessly integrating with the Exness platform. Its intuitive design benefits both new and seasoned traders, enabling strategic trading through quick calculations for diverse scenarios.

How to Access the Exness Calculator

Access the Exness Trading Calculator with ease, whether you’re at your desk or on the move. This guide walks you through the simple steps to access this essential trading tool via the Exness website and mobile app, ensuring you can always make well-informed trading decisions wherever you are.

Website Navigation

Accessing the Exness Calculator is straightforward via the Exness website. Here are the steps to follow:

- Visit the official Exness website.

- Navigate to the “Tools” section found typically in the menu bar.

- Select “Calculator” from the dropdown menu to access the profit calculator.

This process enables users to quickly find and utilize the calculator to assess potential trade outcomes before making commitments.

Mobile App Integration

For traders on the go, the Trading Calculator is also integrated within the Exness mobile app. Here’s how to access it:

- Download and open the Exness mobile app.

- Sign in to your Exness account, or create a new one if you haven’t already.

- Locate the “Tools” or “Calculator” option within the app menu.

- Tap on it to open the calculator and start using it for your trading calculations.

This integration ensures that Exness traders can always have the calculator at their fingertips, regardless of where they are.

| Feature | Description | Input Parameters | Output |

| Position Size Calculation | Determines the optimal trade size based on account balance, risk tolerance, and currency pair | Account balance, risk percentage, stop-loss in pips, currency pair | Position size in lots |

| Margin Calculation | Calculates the required margin to open a trade based on leverage and trade size | Leverage, trade size (lots), currency pair | Required margin |

| Profit and Loss Calculation | Estimates potential profits or losses for a given trade | Entry price, exit price, trade size (lots), currency pair, and account currency | Estimated profit or loss |

| Swap Calculation | Calculates the swap or rollover fees for holding a position overnight | Trade size (lots), swap rate, currency pair, number of nights the position is held | Swap cost |

| Pip Value Calculation | Calculates the value of one pip movement in the base currency of the account | Currency pair, trade size (lots), and account currency | Pip value |

| Conversion Rates | Provides real-time conversion rates for calculating margin, profit/loss, and swap in the account currency | Account currency, base currency, quote currency, conversion rate | Converted amounts in the account currency |

| Leverage Impact | Shows how different leverage settings affect margin requirements and potential returns | Leverage ratio, trade size, currency pair | Impact on margin and potential returns |

Key Features of the Exness Trading Calculator

The Exness Trading Calculator is engineered with precision and user convenience in mind, incorporating several key features that cater to the diverse needs of traders. Below is a table highlighting its primary functionalities and how they contribute to a trader’s success:

| Feature | Description |

| Real-Time Asset Valuation | Provides up-to-the-minute pricing on various assets, enabling traders to calculate potential profits or losses based on current market conditions. |

| Risk Assessment Tools | Offers detailed insights into potential risks associated with trades, including stop-loss levels and margin requirements, helping traders manage their risk exposure effectively. |

| Investment Goal Setting | Allows traders to set and adjust investment goals, facilitating the development of a personalized and strategic approach to trading based on calculated outcomes. |

| Leverage Effect Analysis | Enables traders to understand how different leverage levels can impact their trade outcomes, allowing for better risk management and capital allocation. |

| Pip Value Calculation | Calculates the value of a pip in the trader’s account currency for forex trades, providing vital information for assessing risk and potential profit or loss per trade. |

Using the Exness Trading Calculator

Using the Exness Calculator is an essential step for traders aiming to make informed decisions about their potential investments. This calculator provides a dynamic platform for evaluating various trading scenarios, helping users forecast potential profits and losses with greater accuracy. Here’s a more detailed exploration of how to utilize this tool effectively.

Input Parameters Explained

- Account Type: Different types of accounts may have unique features like commission rates or swap fees, affecting trade profitability.

- Account Currency: The currency of your trading account. Calculations are done in this currency, making it important for understanding profit or loss in terms familiar to you.

- Instrument: The asset you’re trading (e.g., currency pairs, commodities). Each has unique characteristics influencing price movements and potential returns.

- Lot (Trade Size): The volume of your trade, with one standard lot typically representing 100,000 units of the base currency in forex. The size of your trade directly impacts potential gains or losses.

- Leverage: Indicates how much larger your trade can be compared to your initial investment. Higher leverage increases both the potential profit and the risk of loss.

Step-by-Step Guide to Using the Exness Calculator

- Choose the Calculator: Start by selecting the Exness Investment Calculator on the platform.

- Input Account Details: Specify your account type and account currency. These factors influence trade conditions and currency conversion calculations.

- Select Your Trading Instrument: Choose the instrument you wish to trade. Different instruments have varying levels of volatility and market dynamics.

- Enter Lot Size: Input the number of lots you plan to trade. The lot size affects the magnitude of potential profit or loss.

- Set Leverage: Choose the leverage level for your trade. Leverage can amplify outcomes but also increases risk.

- Calculate: Once all inputs are entered, proceed to calculate. The tool will provide an estimation of potential profit or loss based on the provided parameters.

Benefits of Using the Exness Trading Calculator

The Exness Calculator is an invaluable tool for traders, offering a multitude of benefits that enhance trading performance and decision-making processes. Here’s a list of the key advantages of utilizing this calculator:

- Precise Profit and Loss Estimations: Offers accurate calculations of potential profits and losses before executing trades, allowing traders to assess the viability of their strategies.

- Improved Risk Management: Helps in determining risk exposure by calculating potential losses, enabling traders to set appropriate stop-loss orders and manage their risk more effectively.

- Enhanced Planning for Financial Goals: Facilitates the setting of realistic financial goals by providing insights into potential returns on investments, aiding traders in planning their financial future.

- Informed Decision Making: Empowers traders with detailed insights into potential trade outcomes, enhancing the quality of trading decisions based on solid data analysis.

- Strategic Trade Adjustments: Allows traders to adjust trade parameters (such as trade size and leverage) in real-time to see how different scenarios affect the potential outcome, fostering a more strategic approach to trading.

- Ease of Use: With its user-friendly interface, the calculator simplifies complex calculations, making it accessible to traders of all experience levels.

Examples of Exness Calculator in Action

The Exness Calculator serves as a vital tool for traders, providing detailed insights into potential trade outcomes across different scenarios.

Exness Trading Calculator

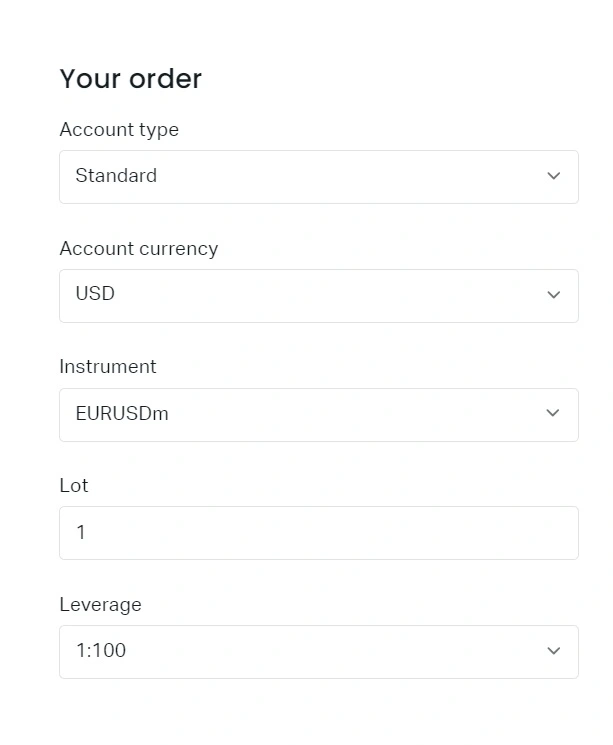

Scenario: A trader is looking to take advantage of the EUR/USD currency pair, predicting that the Euro will appreciate against the US Dollar. The trader inputs the necessary details into the Trading Calculator as follows:

- Account Type: Standard

- Account Currency: USD

- Instrument: EUR/USD

- Lot Size: 1 lot (100,000 units)

- Leverage: 1:100

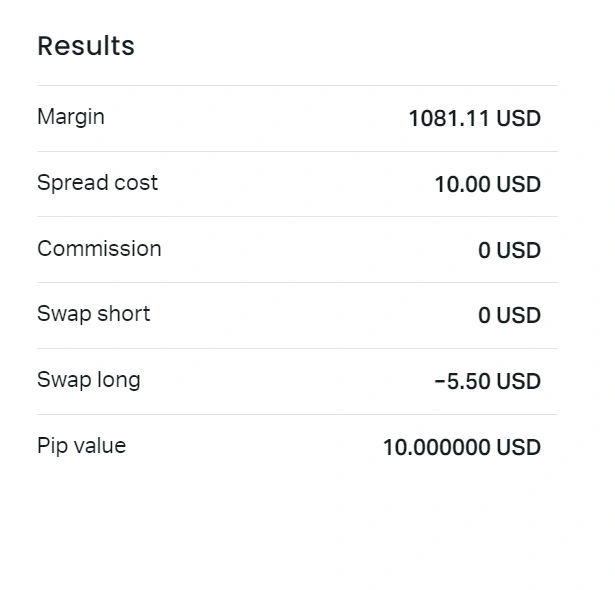

The results detail the costs and values for a specific trade:

- Margin: $1081.11 – The required deposit to open and maintain the position.

- Spread Cost: $10 – The fee due to the price difference between buy and sell at trade entry.

- Commission: $0 – No additional fee for executing the trade.

- Swap Short: $0 – No interest charge for holding a short position overnight.

- Swap Long: -$5.50 – The cost for holding a long position overnight.

- Pip Value: $10 – Each pip movement in the trade’s favor or against it results in a $10 change in value.

In essence, to hold this trade, you need an initial margin of $1081.11, pay $10 for the spread, and if holding long overnight, incur a $5.50 fee. Each pip change impacts your account by $10.

Exness Leverage Calculation

Leverage in trading is essentially using borrowed funds to increase the size of a trading position beyond what would be possible with one’s own capital alone. It’s a powerful tool that can amplify both potential profits and losses from market movements. The leverage calculator allows traders to understand how using different leverage levels can impact their trading positions and required margin.

Tips for Maximizing Investment with Exness

Maximizing investments on the Exness platform involves a blend of strategic planning, continuous learning, and effective risk management. Here are practical, actionable tips designed to help traders optimize their use of the Exness platform and its tools, particularly the Exness Calculator:

- Always use the Exness Calculator before making trade decisions to ensure informed choices.

- Keep abreast of global financial news to understand market conditions affecting your trades.

- Adjust your trading strategies based on insights gained from the calculator’s feedback.

- Implement risk management by setting stop-loss orders and understanding your risk tolerance.

- Diversify your portfolio by investing in a variety of instruments to spread risk.

- Choose leverage levels wisely, aligning them with your risk appetite for better control.

- Test new strategies in a risk-free environment using an Exness demo account.

- Continuously improve your trading skills by utilizing Exness’s educational resources.

- Regularly review and learn from your trading history to refine future strategies.

- Stick to your trading plan with discipline and patience for consistent long-term gains.

Summary

The Exness Calculator is a vital component of the Exness trading platform, offering traders a robust array of features to enhance decision-making. It integrates real-time market data for precise trade analysis, includes risk assessment tools for effective risk management, and supports setting realistic investment goals. By calculating potential profits, losses, and understanding trade-related costs like spreads and swaps, traders can strategize with greater accuracy. This tool underscores Exness’s dedication to equipping traders with essential resources to navigate the markets confidently and successfully.

The trading calculator is provided for illustrative purposes only. The results presented by this calculator are for educational and estimation purposes and you should not rely upon it as being complete and for making investment decisions. Real-time results can only be determined at the time of order execution.

Improve your Exness trading

Find out for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs about Exness Calculator

How do you calculate profit in Exness?

To calculate profit in Exness, enter your trade size, leverage, and the open/close prices into the Exness Calculator. It quickly computes potential profit or loss, adjusting for the specific financial instrument. This tool simplifies evaluating trade outcomes, helping traders make informed decisions.

What is the best leverage for a $10 account on Exness?

For a $10 account on Exness, a leverage of 1:30 to 1:50 is generally recommended. This range offers a good balance between increasing potential returns and controlling risk, suitable for traders with small accounts who seek to maximize their trading opportunities while managing their exposure.

What is leverage and margin in Exness?

Leverage in Exness means using borrowed funds to increase potential trade size and returns, while margin is the required deposit to open and maintain a leveraged position. These concepts are central to forex trading, allowing traders to control large positions with a relatively small capital outlay.

Can I trade with $10 dollars on Exness?

Yes, you can start trading on Exness with just $10. This low minimum deposit makes it accessible for beginners to enter the market, offering opportunities to trade various instruments within a risk-managed environment.

Can I start forex with $50?

Absolutely, starting forex trading with $50 is possible on Exness. This initial investment allows newcomers to explore forex markets, practice trading strategies, and gain experience without a significant financial commitment.

What does the Exness Trading Calculator offer traders?

The Exness Trading Calculator provides traders with essential information on the required margin for their trades, considering chosen leverage and trade size. It’s a crucial tool for managing risk and ensuring that traders maintain adequate capital levels to support their trading positions.

What are the key features of the Exness Calculator?

The Exness Calculator boasts key features like real-time asset valuation, comprehensive risk assessment tools, and the capability for traders to set and evaluate investment goals. These functionalities empower traders to make strategic decisions based on accurate, current market data.

How does the Leverage Calculation on Exness help traders?

The Leverage on Trading Calculator aids traders by demonstrating the impact of different leverage levels on their trading positions and required margin. Understanding these effects is vital for effective risk management and for tailoring trading strategies to fit one’s risk tolerance and capital availability.